The Top 5 Multi-Family Investing Questions

Multi-family investing is a common topic mentioned in the real estate world but remains an opportunity that many individuals have yet to capitalize on.

However, not many people have a full understanding of multi-family investments. There is a desire to invest in real estate, but long-term investment plans must be considered when acquiring a property.

When considering getting started with different aspects of multi-family investing, there are 5 important questions to ask yourself:

What qualifies as multi-family housing?

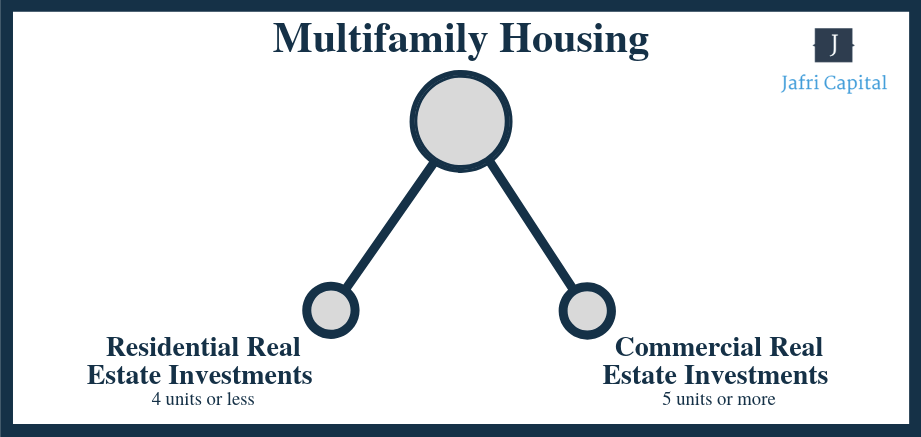

First and foremost, “multi-family” is defined as two or more adjacent housing units that share physical systems, such as roofing or heating. It can also refer to townhome-style residences that share amenities, such as a pool, gym, or common area. There are 2 main categories under multifamily investments: residential, which are 4 housing units or less, and commercial, which are 5 housing units or more.

Should I invest in commercial real estate or residential real estate multifamily housing?

The answer here is based on time as well as your experience with medium to large investments. The time of the project will determine the standards of property financing and the correct tenants for rental property management. If residential real estate is a part of your previous experience, your opportunities for bigger, more profitable investments could be grown through commercial investments. Therefore, branching out from the traditional singular home residential investments and moving to commercial multi-family investments could be the next step in your legacy.

How do Investors decipher quality?

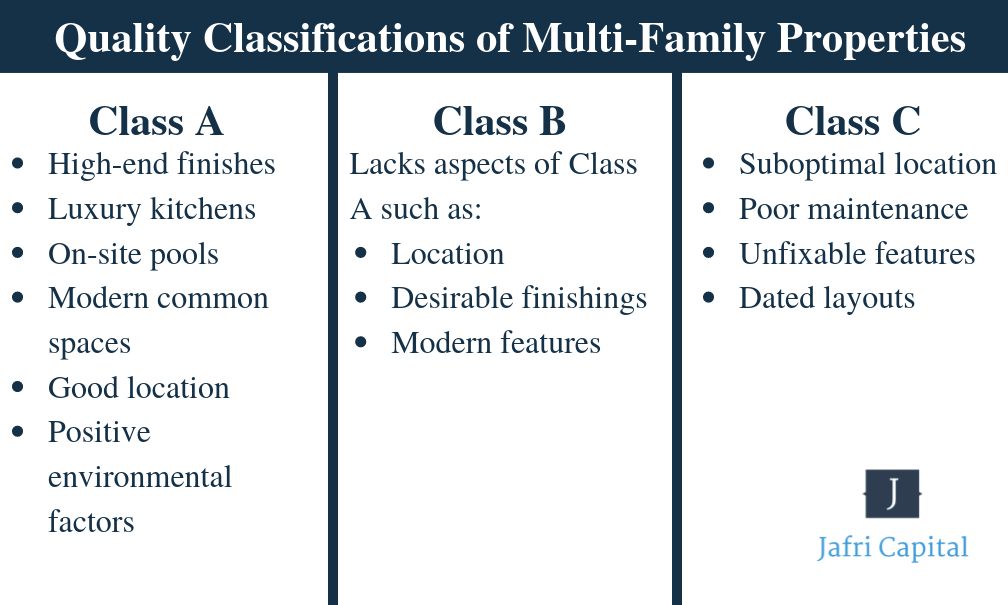

The quality of the multi-family real estate property is one of the most direct influences on if the investment is going to be worth your time. Without quality, is it only going to be a hassle? Is your time more valuable than the long-term dollar? We break down multi-family real estate into three main classes below.

While it may be attractive to go with Class A because of the lack of physical work needed to move-in residents, the price will be higher for that same reason. With Class B or C properties, rents are considerably lower and, consequently, so are the investments. All the reason why quality will be a main factor when considering the tradeoffs.

What Market Trends affect Multi-Family Investing?

Multiple economic trends affect multi-family investing on macro and micro levels that are out of your control. Generational shifts, global and market economies, location of the property, and affordability are a few, rather common trends that can shift your investment point of view.

For example, as baby boomers retire, the common move will be to downsize on a northern property to a southern retirement home. This often means that the older generation will have less motivation to maintain the property, decreasing the value of a Class A property and creating a worthwhile investment opportunity.

How do you get started with multi-family real estate?

Breaking into multi-family real estate may be the biggest wall between you and endless investment opportunities. Jafri Capital can eliminate the stress behind your investment through our services. With the guidance of real estate experts and the backing of an experienced intermediary with proven success in ventures like yours, the possibilities become more feasible and, not to mention, more likely to produce a significant ROI.

What will you do with your property once you own it?

This last question is the most important to ask yourself in order to truly judge if the investment is right for you.

Whether it is quickly flipping your investment for a substantial profit or relying on tenants over time to repay the property, your strategy CAN NOT be overlooked. Not to mention, the opportunities that your investment can lead to which may not be on the top of your mind. Your strategy is something often thought to be self-explanatory, but Jafri Capital will help create a cadenced plan for you capitalize on each of the following:

- Real estate investment portfolio

- Operations policies and procedures

- Ability to attract partners

- Ability to be proactive

- Exit strategies

For Example…

Jafri Capital recently arranged LP Equity for a value-add multifamily transaction in the Bronx. The sponsor purchased the asset capex through a two-phase value add strategy, as the asset was delivered vacant. The sponsor planed on a gut renovating the asset and stabilizing it through a cash-out refinance. This was a great opportunity for the investor to diversify their investment portfolio and allocate an investment for 3x multiple on cash investment. All of this was made possible through the services of Jafri Capital, so be sure to reach out for more information on how we can help you!

Check out our next article on multi-family housing, and see how your strategy can be implemented for the maximum benefit of your investment. As always, Jafri Capital is open to consultations to see how your vision can be brought to reality.

Great Blog I wish I had one like this on my site.

Hi there mates, how is all, and what you wish for to say regarding this piece of writing, in my view

its genuinely amazing designed for me.