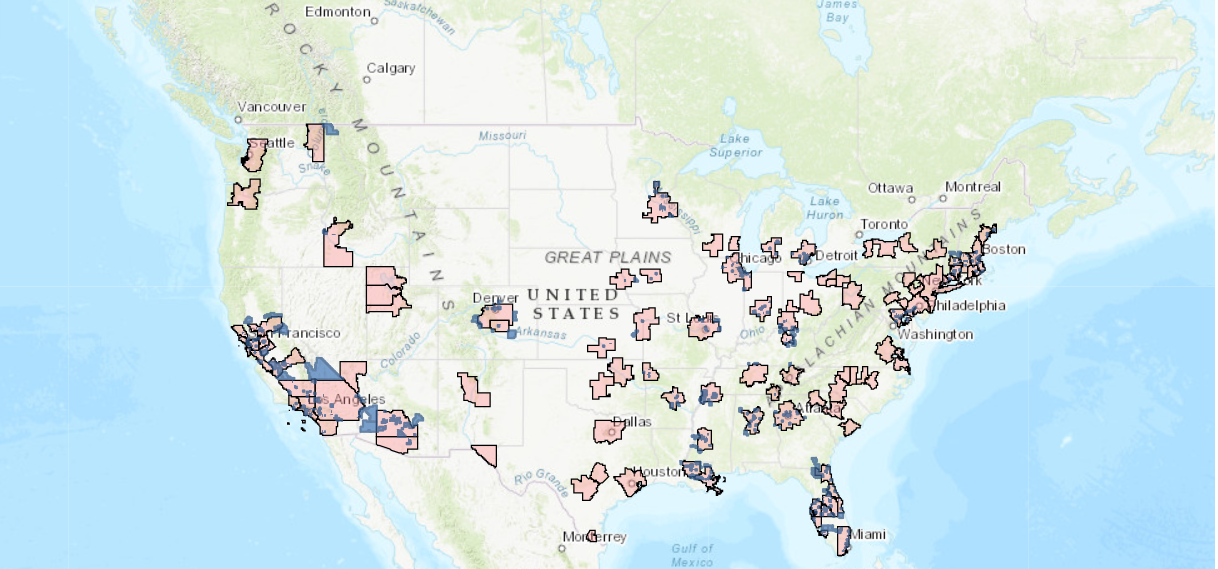

A Qualified Opportunity Zone is a designated census area selected by state governors and certified by Treasury for economic development. It is a historically underinvested area and can be found in urban, suburban and rural areas of every state. A QOZ is designed to spur economic development and job creation in distressed communities.

Qualified Opportunity Fund (QOF)

A Qualified Opportunity Fund is an investment vehicle that holds at least 90% of its assets in QOZs. A QOF creates a set of powerful tax incentives to roll over unrealized capital gains for investors.

Benefits of Investing in QOFs

Defer paying capital gains tax until December 31st, 2026 according to the current Tax Reform in 2017.

Reduce tax payment by 10% if the capital gains are held in a QOF for 5 years. (by 15% if held for 7 years).

Pay zero capital gains taxes on your QOF investment profit (if held for at least 10-years), while still paying 15% less of your original investment capital gains tax.

Extreme Effects on ROI and Equity Multiple

For Example

- $1,000,000 capital gains are invested in QOF and held for 10 years

- 15% of 1M is abated => pay capital gains tax on $850,000 (includes highest federal gains rates of 20%, with a 3.8% net investment income tax) by December 31, 2026.

- Any amortization on the property as well as sale or exchange gain is not taxable.

In the chart above, after tax return of 1.9 multiple is equivalent to a non-QOZ investment earning net multiple of 2.49 once taxes are considered. In other words, to make the same amount of after-tax revenue of $1,802,815.00, investor will have to earn a 2.49 net multiple, after taxes, on a non QOZ investment.

Opportunity Zone Map